Since that initial recovery, the normal, post-recession trajectory has been curtailed by heavy government intervention and misguided Federal Reserve action. Beyond the Fed, the tone and policy coming out of Washington (namely Dodd-Frank and Obamacare) has stymied the U.S economy, permitting sluggish expansion for the past couple years.

Recently, there have been some sign of economic improvement, most notably from the recovering housing market and improved consumer sentiment; however we are not out of the woods yet. The Fiscal Cliff is looming and could derail growth prospects for 2013, potentially into 2014.

Considering how far we have come and at what cost to the Fed’s balance sheet, it is worth understanding where the domestic economy is and the factors at play globally. This will allow you to understand exactly what the government is risking due to their bickering. In other words: looking through the cliff.

Domestic Economic Backdrop

The U.S. is currently in a unique economic pattern as many of our key indicators are telling conflicting stories. Looking at these areas in the context of a normal economic cycle should offer some clarity.

Early Cycle Indicators

The improvements in the housing market over the past 4-6 months have been very constructive. “The broad improvement in home prices, home equity, starts, and inventory clearing are key developments” (Mutikani, 2012) which typically would imply a strengthening economy poised for significant growth. This is due to the vast trickle-down effect that positive housing sector numbers typically have on other areas, including consumer spending and manufacturing, as well as unemployment.

Even with some positives in manufacturing tied to domestic housing, manufacturing as a whole has been on a steady decline, largely in part to global headwinds.

Going hand-in-hand with housing progress is the upward improvement in consumer confidence that began in September and carried through October. Despite a [November] decline in confidence about their personal finances, 39% of consumers have plans to increase their spending in December (Fox-Rubin, 2012).

On a side note, the positive increase in housing and consumer sentiment may have been the shadow-factor in the outcome of the Presidential Election as they blunted the effectiveness of Mitt Romney’s Economic Campaign. Allowing voters to more freely focus on social issues as opposed to the sluggish economy.

Mid Cycle Indicator

Credit has been expanding almost continuously since mid-2010 as the country recovered from the 2007-09 recession, and the recent expansion could boost economic growth by helping consumers spend more on cars and education (Reuters, 2012). The loose credit that has been available due to easing is finally providing a tailwind to consumer markets. Beyond housing starts, other large, big-ticket items are entering the fray with more regularity. This is a classic mid-cycle indicator.

Late Cycle Indicators

Due to the over-bloated nature of the pre-recession era, the private sector has learned to run lean by attempting to optimize the efficiency of each employee. Because of this, cyclical productivity has been maxed and has stopped expanding.

Typically this is an inflationary factor; however with a slow economy, relatively high unemployment, and a poor global market, these pressures have not been realized.

There is, however the “cash on hand” variable in the private sector that could impact cyclical productivity. Deployment of this capital could lead to a wave of hiring if corporations decide to fatten up again. I find this to be a bit of a stretch as companies have found fiscal success and increased efficiency while running lean for the past five years (Senel, 2012).

That leads us to our natural conclusion.

What is the Fiscal Cliff?

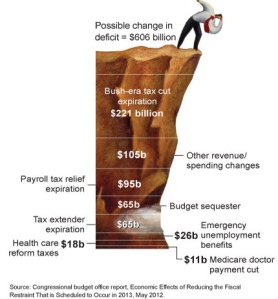

Going over the “fiscal cliff” would be the only indicator pointing towards recession, albeit an “almighty” one. As it stands, about $600 billion in fiscal tightening would transpire as a result, representing roughly a 4% drop in GDP. Considering GDP is currently growing at 2.7%, those cuts would instantly throw plunge the U.S. into recession.

On the corporate side of things, analysts as a whole indicate that this would impact corporate profitability by about 20-30%, which would compound the impact of high unemployment and decreasing median income.

Global Economic Backdrop

The global economic story is a tale of opposites: growth in China and recession in Europe.

The European Leading Indicator Diffusion Index indicates that only 30% of the key economic indicators in Europe are trending positive. As if this we not enough, the toll of supporting Europe has finally proven to be too much for Germany and the Scandinavian countries. “A slump in the German economy would remove a rare engine of demand for the rest of the continent, probably extending the euro-area-wide recession that was confirmed last quarter” (Kennedy, 2012).

In addition, overall sentiment in Europe is depressingly low. A recent Gallup poll confirmed this sentiment, indicating that in 16 of the 27 countries polled, adults were overwhelmingly discontent (>75%) (Manchin, 2012).

With the issues of Europe and the Fiscal Cliff catching front-page headlines, the story of Asian recovery has been largely overlooked.

“Hong Kong’s GDP rose last quarter after declining the previous three months…with regional growth will probably recovering this quarter” (Lester, 2012). With China and greater Asia primed for a growth, the global economy could begin to see improvements, especially beleaguered export markets of the South America, along with the U.S. and Germany.

The Waiting Game

There is a lot going on in the world economics beyond the Fiscal Cliff. Considering the backdrop, there is a sense that the global situation (sans Europe) is turning the corner.

However, building on the semblance of positive undertones hinges on a group of policy makers reaching a responsible agreement. Although this sounds simple enough, with petty bickering coming out of the Oval Office and Congress, there is no definite that a definitive solution can be reached.

If the U.S. does go over the cliff, even if temporarily, expect the improvements that have been made to be lost, and for the economy to enter the recessionary phase, only this time without expensive tools from the Federal Reserve to prop it back up.

The foundation is there with improved housing. If Congress and the Obama Administration can come to some kind of deal, it will free up the private sector’s ability to deploy capital effectively, which would promote expansion. Again, that is a big “IF”. However, if they are successful, the U.S. could begin to experience what would actually resemble “normal” economic times once again.

UPDATE: At around 2 a.m. on January 1, 2013, the Senate passed a compromise bill, the American Taxpayer Relief Act of 2012, by a margin of 89–8.

*****

Erol Senel has been plying his trade in the world of finance and personal investing. Through this real world experience, he has found his true professional passion in economics and financial history.

Reference

Fox-Rubin, B. (2012, Dec 5). Discover U.S. Spending Monitor: Consumer Confidence Drops in November. NASDAQ. Retrieved from http://www.nasdaq.com/article/discover-us-spending-monitor-consumer-confidence-drops-in-november-20121205-00254

Kennedy, S. (2012, Nov 30). Germany Seen Resession-Bound in Poll Showing Euro Crisis. BloombergBusinessweek. Retrieved from http://www.businessweek.com/news/2012-11-29/germany-seen-recession-bound-in-poll-showing-euro-crisis-deepens

Lester, K., Munoz, Y., Munoz, M. J. (2012, Nov 12). Asia Seen Nearing End of Slowdown on China Recovery: Economy. Bloomberg. Retrieved from http://www.bloomberg.com/news/2012-11-15/asia-seen-nearing-end-of-slowdown-on-china-recovery-economy.html

Manchin, A. (2012, Nov 27). Jobs Outlook Dismal Across EU. Gallup. Retrieved from http://www.gallup.com/poll/158918/jobs-outlook-dismal-across.aspx

Mutikani, L. (2012, Nov 20). Housing starts hit four-year high in October. Reuters. Retrieved from http://www.reuters.com/article/2012/11/20/us-usa-economy-idUSBRE8AI0OQ20121120

Reuters (2012, Nov 7). U.S. consumer credit expands, but credit card usage sags. Reuters. Retrieved from http://www.reuters.com/article/2012/11/07/us-usa-economy-credit-idUSBRE8A629A20121107

Senel, E. (2012, Nov 27). The New Unemployment Normal. Senel Slant. Retrieved from http://senelslant.com/2012/11/27/the-new-unemployment-normal-for-now/

No comments:

Post a Comment